IMF's Role and Structure

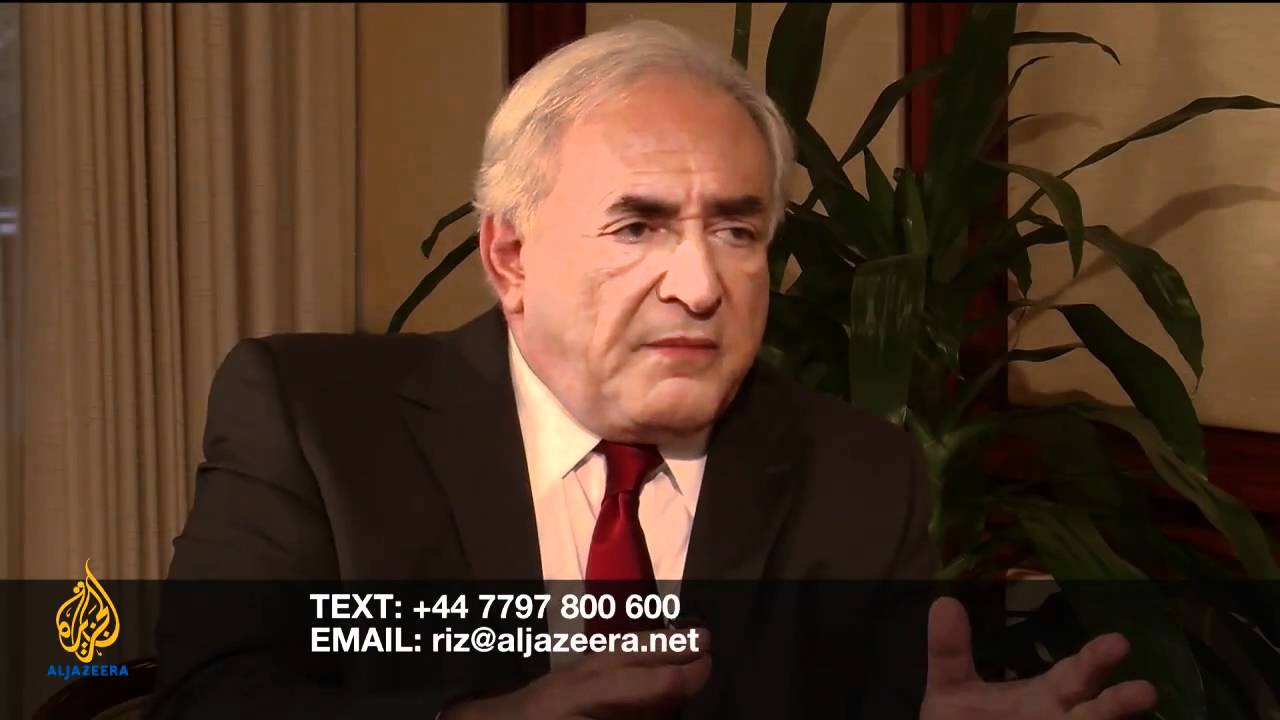

Dominique Strauss-Kahn, the Managing Director of the IMF, acknowledges the need for restructuring the IMF's membership to give emerging economies a greater voice. He believes that European countries will eventually agree to this change, recognizing the need for the IMF to be a legitimate institution for all countries.

The IMF's voting structure is being criticized, with countries like China having less power than smaller countries like Belgium.

IMF's Lending Practices

Strauss-Kahn defends the IMF's lending policies, arguing that the organization is not a charity but a financial institution that uses money contributed by member countries. He emphasizes that the IMF is essentially a credit union where countries help each other in times of need, but expect to be repaid.

He acknowledges that the IMF has faced criticism for its lending practices, particularly in cases like Pakistan and Haiti, where countries have been given loans despite already being in debt. He explains that these loans were provided in extraordinary circumstances, such as the aftermath of natural disasters.

Strauss-Kahn clarifies that the IMF can forgive debt in exceptional cases, as it did with Haiti after the earthquake. However, he emphasizes that this is not a standard practice and that the IMF generally expects to be repaid.

He highlights a recent change in the IMF's lending practices, where it now offers loans to some countries at a zero interest rate. This is a new approach that aims to help countries in need without burdening them with excessive debt.

The IMF has implemented a zero interest rate policy in Haiti since 2011, which will be reviewed at the end of the year.

The IMF's lending policies are influenced by the power dynamics within the organization, with powerful countries potentially attaching softer conditions to loans for strategically important nations.

The IMF's role in Haiti and Pakistan during the Cold War highlights the potential for political influence in its lending practices.

The IMF often provides loans to strategically important countries, such as Pakistan, which has received large loans during its time on the UN Security Council. These loans may help the government in power, but the burden of repayment often falls on the poor.

While the IMF has been criticized for its policies, South Korea, a strategic ally of the United States, thrived under IMF programs during the 1960s and 1970s. This suggests that good governance at home is also crucial for success.

IMF's Impact on Global Economy

The IMF acknowledges that joblessness is a major problem globally, and while economic growth is positive in some regions, it may not be enough to reduce unemployment in others, particularly in the US and Europe.

The IMF recognizes that different countries require different approaches to economic recovery, with some needing to cut spending immediately, while others have more room to maneuver.

The IMF's World Economic Outlook report will be released soon and will revise upward the average forecast for growth, but will also highlight downside risks, including a jobless recovery and the need for continued financial sector regulation and supervision.

The IMF believes that a double-dip recession is unlikely, but acknowledges that it is a possibility.

The IMF is facing challenges in maintaining global financial stability, including the risk of a currency war.

The IMF's role in promoting economic growth and reducing poverty is being questioned, particularly in light of the power dynamics within the organization.

Emerging Economies and the IMF

Many emerging market countries, particularly after the East Asian financial crisis, have moved away from the IMF and towards self-reliance, accumulating foreign currency reserves.

Regional organizations, such as the Chiang Mai Initiative in Latin America and the Banco de sha, are emerging as alternatives to the IMF, allowing emerging market countries to have a greater say in their own economic policies.

Not all developing countries are poor. Saudi Arabia, for example, is a high per capita income country that has a significant voting share in the IMF due to its oil wealth and strategic alliance with Western countries.

China and the IMF

Dominique Strauss-Kahn, former IMF Managing Director, has called for China to speed up the appreciation of its currency, a move that is being debated in the international community.

Riz Khan states that the IMF is not in a position to dictate policy to China because China is too powerful.

He suggests that the issue is between the United States and China.

Riz Khan notes that the United States used to have a fixed exchange rate, but it is costly to maintain.

He explains that the United States now has a floating exchange rate, while China maintains a fixed exchange rate.

This creates a problem because the dollar has nowhere to go when the United States has a deficit.

Riz Khan concludes that the Chinese currency is likely undervalued.